Search results

.webp)

Ashley brings experience in people operations across the full employee lifecycle to M13, supporting both the internal team and portfolio companies. She is passionate about optimizing processes and enhancing workplace culture through a thoughtful, people-first approach. She holds a BS degree in Human Development from UC Davis. Outside of work, she enjoys cooking for friends, exploring new places, and making lamps.

.webp)

As a Business Analytics Engineer on the propulsion team, Will works on building data pipelines and and systems to manage the flow of information within the firm. Prior to joining M13, Will worked as a data scientist at a defense think tank in Washington D.C., where he first learned how to use different programming methods and tools in production.

.webp)

Amedeo is an investor at M13, partnering with ambitious founders and connecting them to M13’s community and resources to accelerate company building. Prior to M13, he was a investor at Picus and an investment banker at J.P. Morgan advising early‑ and growth‑stage technology companies; he holds a BS from Babson College.

%20(1).webp)

As Event Coordinator at M13, Abby plans and manages events, logistics, and strategy for gatherings that bring people together. She has worked in the event space across private equity, nonprofit, and now venture capital, and feels deeply inspired by the power of human connection and the impact a well-crafted event can have. Outside of work, Abby is a competitive bodybuilder and devoted dog lover.

.png)

As the Office Coordinator for M13's New York office, Xochilt supports the M13 team, portfolio companies, and any guests both in the office and behind the scenes. Prior to joining M13, she spent several years in the coworking industry. She holds a BA in Communications from Saint Peter's University, with a minor in Social Justice. In her spare time, Xochilt enjoys attending concerts with friends, cooking new recipes, and making new furry friends while dog sitting.

.webp)

As a sales and go-to-market analyst, Cassie helps M13 portfolio companies optimize their sales process. She brings experience working with several VC-backed startups in Silicon Valley, as well as her time at Oracle and Team Huddle. Cassie holds a BS from California Polytechnic State University. She loves working with startups and supporting their growth during the early stages.

.webp)

Whitney invests in ambitious founders and connects them with M13’s community and resources, with a focus on the Bay Area. Prior to M13, she worked in GTM roles at tech companies of all stages—including Google, GoCardless, and Relay.app—and in venture at January Ventures and Peterson Ventures. She holds an MBA from Stanford University and a BA in Public Policy from Duke University. When she’s not meeting new founders, Whitney enjoys hiking, hosting dinner parties, and triathlon training.

.webp)

Sebastian helps M13 and its portfolio companies identify and recruit incredible talent. He has a background in program management in the higher education and non-profit sectors. Sebastian first came to M13 as a participant in Recruiter Academy. He holds an MS in Higher Education from Florida International University and a BA in Neuroscience from Pomona College.

.webp)

Peter sits on the Mission Control team to help streamline M13’s largest cross-functional projects. Prior to joining M13, he worked at Meta, where he helped improve advertising tools and infrastructure after graduating from USC with an MBA—a somewhat unlikely path for a double major in Philosophy and Film Production. In his spare time, he is a 3D printing enthusiast.

.webp)

Andrew is VP of Finance at M13 and helps lead finance initiatives internally as well as with portfolio companies. His career has spanned roles across private equity, corporate finance, and M&A consulting and advisory. He holds an MBA from the University of California Berkeley Haas School of Business and a BA in Business Administration from the University of San Diego. Andrew lives in Los Angeles with his wife and three children.

.webp)

Courtney co-founded M13 in 2016 with his brother Carter. The duo also started and sold the spirits brand VeeV, and authored the bestselling book “Shortcut Your Startup.” A former Goldman Sachs investment banker, he serves on boards such as Lifeforce, Thrive Global as well as philanthropic endeavors like YPO, US Soccer Federation Foundation, the Los Angeles Mayor’s Office and LA Opera.

.webp)

Karl is the Managing Partner at M13. Karl was previously the COO of DigitalOcean, where he helped scale the business from first product over six years and prepared it for its eventual IPO (NYSE: DOCN). During his full 20 year operating career, Karl also co-founded and ultimately exited two other technology companies as CEO.

.webp)

Latif manages the overall investing strategy for the firm and has led numerous deals across money and health verticals with a large focus on web3. He was previously the managing director at Virgin Group where he led investing in the Americas including investments in Ring (acq. by AMZN), Slack (NYSE: WORK), Virgin Galactic (NYSE: SPCE), and Virgin Orbit (NASDAQ: VORB).

.webp)

A partner at M13, Anna was the managing director of Techstars LA and also a partner in The Fund LA. A certified executive coach, Anna has worked as a corporate lawyer, McKinsey consultant, product exec, and entrepreneur. She serves on the Advisory Board of PledgeLA and is a member of AllRaise.

.webp)

A partner and head of legal, Win has served in senior leadership roles at numerous consumer technology companies, including as General Counsel of MasterClass and early-stage startup Vessel (acquired by Verizon), as well as senior legal and business affairs roles at Hulu. A former electrical engineer, he started his legal career as a corporate attorney at Latham & Watkins

.webp)

A partner and head of brand/communications, Christine worked with Sir Richard Branson to launch Virgin Group’s North American portfolio and was the first head of communications for Virgin Galactic/Virgin Orbit/The Spaceship Company. She serves on the boards of KIPP NJ and Virgin Unite US.

.webp)

As a partner and head of talent, Matt coaches our founders on hiring the best talent and building healthy and high-performing cultures. He leads several of our future of work investments. Matt previously built and led the People functions at DigitalOcean and Return Path (#1 Best Place to Work in NYC and #2 in the US, respectively).

.webp)

Brent Murri is a Partner at M13 where he leads early-stage investments in software and marketplaces. Brent joined M13 from Battery Ventures where he focused on growth-stage enterprise software investments. Prior to Battery, he worked in strategy & business development for Samsung NEXT, where he developed and executed strategies around Samsung’s mobile software and services initiatives.

.webp)

Rob helps startups strategically build, deploy, fundraise, and go to market. Prior to M13, Rob has been a serial founder as the CEO of BlackSmith Studios and Pecabu, as well as acting in an interim-CMO/CPO capacity at a number of later-stage Bay Area VC-backed companies, including Cala Health, Apnicure, Neodyne & others. He is a recipient of UK Entrepreneur of the Year in 2012.

.webp)

John is Partner and Head of Launchpad, the M13 Venture Studio helping founders build companies that define the future of business. Prior to M13, John founded and scaled The Bouqs Company and worked in strategy for The Walt Disney Company and Bain & Co. John continues to serve Bouqs as Chairman of the Board and also teaches entrepreneurship at UCLA Anderson.

.webp)

Sarah was previously the VP of marketing and investor relations at Arlon Group and has served in IR roles at StepStone Group and Citi Private Equity. She is a public company board member, co-founded the Sustainability Investment Leadership Council, and has served on numerous non-profit boards.

.webp)

As VP of talent acquisition, Loren leads the team that helps our founders build their dream teams. She was previously the director of R&D talent acquisition at Toast (IPO’d 2021), head of talent acquisition at DigitalOcean (IPO’d 2021), head of talent at Yesware, and R&D recruiting lead at VMware.

.webp)

As the director of Launchpad, Andrew helps to lead the design & execution of our in-house venture studio. Prior to M13, Andrew was the business operations manager for Avantstay, a short-term rental and hospitality startup, and an equity research and investment banking analyst for Dougherty & Co.

.webp)

Mariah brings deep expertise in executive search from True Search & Daversa Partners, where she’s helped build executive and founding teams for early-stage venture-backed companies. She's passionate about building diverse, high-impact teams for mission-driven companies changing our everyday lives.

.webp)

As Director of Product, Mary brings her experience as a former co-founder to help portfolio companies strategically design, develop, and optimize the user journey. Mary takes pride in building meaningful relationships with founders and sharing her passion for product design, innovation, and creativity. She’s always excited to collaborate with startups and help them achieve their goals.

.webp)

Zach’s focus is on architecting systems and processes that augment the data backbone behind all of the firm’s operating systems. He held multiple roles at Quovo (acq’d by Plaid) and Plaid, including Technical Lead and Product Manager for Plaid’s Partnerships Team. Prior to joining M13, Zach founded a consultancy focused on data engineering and a SaaS platform for B2B Go-To-Market Teams.

2026 predictions from the M13 constellation

2026 is the year of tangibility. The gap between technological promise and real-world impact will narrow across AI, infrastructure and marketing. Potential becomes proof. Hype becomes measurable value. Systems get stress-tested. Infrastructure catches up to ambition. And leading companies are the ones building durable foundations: efficient infrastructure, fresh data, credible governance, human trust at scale.

Founders, partners and sector experts across our constellation share what they believe will define the next year of economic dualities, regulation and realignment, infrastructure innovation and tangible outcomes.

TLDR

- AI value becomes measurable. Enterprises will finally show clear ROI from generative AI, agentic systems and automation.

- Infrastructure becomes the real moat. From data centers to developer tooling and physical AI models, the technical foundation of AI becomes the story.

- Fresh, governed data becomes the competitive edge. Right-time pipelines, unified teams and compliant context determine which AI systems scale and which stall.

Infrastructure is the battleground and the opportunity

2026 is the year AI could hit the wall — and efficiency becomes the new competitive frontier.

AI is changing the world but the weight of AI on global infrastructure needs is heavy. 2025 was a year of opulent spending, with large firms trying to outspend each other and Nvidia reaping the rewards in growth and valuation. What’s been overlooked is the technical path required to support such a disruption. In coming years the focus will shift: efficiency, developer tooling and cost reduction will dominate.

What must be considered is the barrier to entry that high infrastructure costs introduce to AI startups and the potential impact on longer-term business economics. I believe 2026 will bring a wave of technologies designed to simplify and reduce costs associated with developing AI businesses — developer tools that improve management of AI and data infrastructure, and infrastructure solutions that solve for efficiency and performance at the chip level.

With predictions that global AI data center demand could reach 327 GW by 2030, the industry can’t brute-force its way forward anymore. The race for efficiency will define the next wave of innovation and separate the survivors from the tourists.

M13 Managing Partner

Karl Alomar

The year asymmetry between AI investment and value ends

Over the last few years, there has been an undeniable asymmetry between enterprise investment in AI and return in value. Lots of money has gone into AI; insufficient value has come out.

In 2026, that asymmetry will change: enterprises will utilize generative AI for internal productivity gains and external customer-facing use cases. Agentic AI adoption will be slower but no less impactful. By the end of the year, companies will be able to point to tangible gains in ROI and demonstrate AI's real world value - and still only be benefiting from a fraction of AI's full potential.

The era of asymmetry is ending. 2026 will be the year that companies see tangible gains in ROI that demonstrate AI's real world value.

Luminos.AI

CEO Andrew Burt

Stale data gets exposed: the AI agent stack forces data to grow up

AI agents are about to expose a truth: models are powerful, but stale data makes them dumb. By 2026, enterprises will shift from batch and ad-hoc integrations toward right-time, unified pipelines that continuously hydrate AI systems with trustworthy context. This reshapes org charts. Data, ML, and application teams converge around shared declarative pipelines instead of handoffs. The downstream effect? A widening performance gap. Companies that deliver fresh, governed data to agents will automate entire workflows; companies that don’t will struggle with hallucinations, compliance issues, and operational drag. Fresh data (not bigger models) becomes the real differentiator.

Estuary Co-founder

Dave Yaffe

The next leap in AI comes from physical models, not bigger LLMs

The march toward AGI has advanced rapidly through LLMs but large language models are hitting natural limits. They’ve processed nearly every written word produced by humanity. While synthetic data represents some room for continued improvement, future foundational model advancement may focus more on efficiency and reliability gains.

The next major step will probably come from physical AI models: systems that learn from the real world rather than text using sensors and cameras to learn how the real world works, much like a human being does through experience. The major advantage over LLMs is the nearly limitless amount of data they can process to continue to learn concepts related to science, medicine and human-to-human interactions, an area of weakness in LLMs.

2026 is the year the path toward AGI via physical models begins in earnest.

M13 Partner

Rob Smith

Systems of action become intelligent through enterprise world models and embodied AI

LLMs have reached the limits of what can be learned from static text, revealing gaps in causal reasoning, multi-step planning and real-world reliability. The next frontier is embodied AI and enterprise world models. These systems learn from interaction data generated by sensors, robots, people and operational workflows, capturing how work actually gets done inside organizations.

Embodied AI grounds models in the physical and procedural realities of the enterprise. World models act as simulation engines that mirror a company’s processes, constraints, exceptions and decision pathways, encoding the same tacit knowledge humans built through experience. Together, they unlock complex agentic decision making and make true systems of action possible: agents that can predict outcomes, test strategies in simulation and autonomously execute multi-step workflows.

In 2026, intelligence shifts from “models that know things” to “models that understand and act within environments.” The winners will leverage world modeling, not model size, to automate knowledge work.

M13 Principal

Morgan Blumberg

Real AI adoption: Doctors moving as fast as software

AI will transform every industry but none more than healthcare, where a decade of digital health hype has mostly fallen flat. That’s finally changing. OpenEvidence is already used by 40% of U.S. physicians just 18 months after launch — doctors have never adopted new technology at this speed. Vinod Khosla 's prediction that AI will perform 80% of the doctor’s work stops sounding theoretical in 2026. Non-clinical busy work will be fully eliminated and, more importantly, we will see real strides in care models delivered by AI. AI nurses and AI doctors - digital twins of our favorite clinician – will become prevalent in 2026 allowing for personalization at scale. Physicians will work at the top of their license and high quality coverage across the population will increase. Consumers already trust AI for healthcare, and will see top down directives from health systems and large care providers.

One thing is certain: every AI model will require living, breathing, continuously generated human data to keep getting better.

M13 General Partner

Latif Peracha

Futureproofing goes mainstream as AI and crypto hit energy, finance and healthcare

I am looking forward to the theme of futureproofing in 2026. The world has woken up to the fact that AI is real, even if most use cases to date focus on our insular tech world. Similarly, crypto continues to gain adoption, although on a quieter note. 2026 is the year where we see AI and crypto expand into the real world to solve complex problems that affect society - beyond just the tech world. Rather, the next wave of adoption will come from SMBs and historically non-tech forward industries (e.g., energy/industrials, financial services, healthcare), and the opportunity is to facilitate that adoption that obfuscates complexity.

M13 Principal

Mark Grace

CHROs, not engineers, are AI workforce architects

In 2026 AI will no longer be a tool. Companies will embed AI in their strategy as part of what it truly is: a new architecture for how work gets done. The best ones will design agentic workflows from the ground up, deciding which tasks are owned by people, which are executed autonomously by AI systems, and how the two reinforce each other. Doing this well demands a different kind of leadership profile: close enough to the work to understand the nuances of product, operations and customer feedback and experienced enough to architect workflows and decide where human oversight is essential. And it requires a shift in ownership. AI’s impact is organizational, not just technical. These are not engineering questions, they are people questions. CHROs and talent leaders will become stewards of the AI transformation, defining how work gets done in truly AI-native companies.

M13 Partner

Matt Hoffman

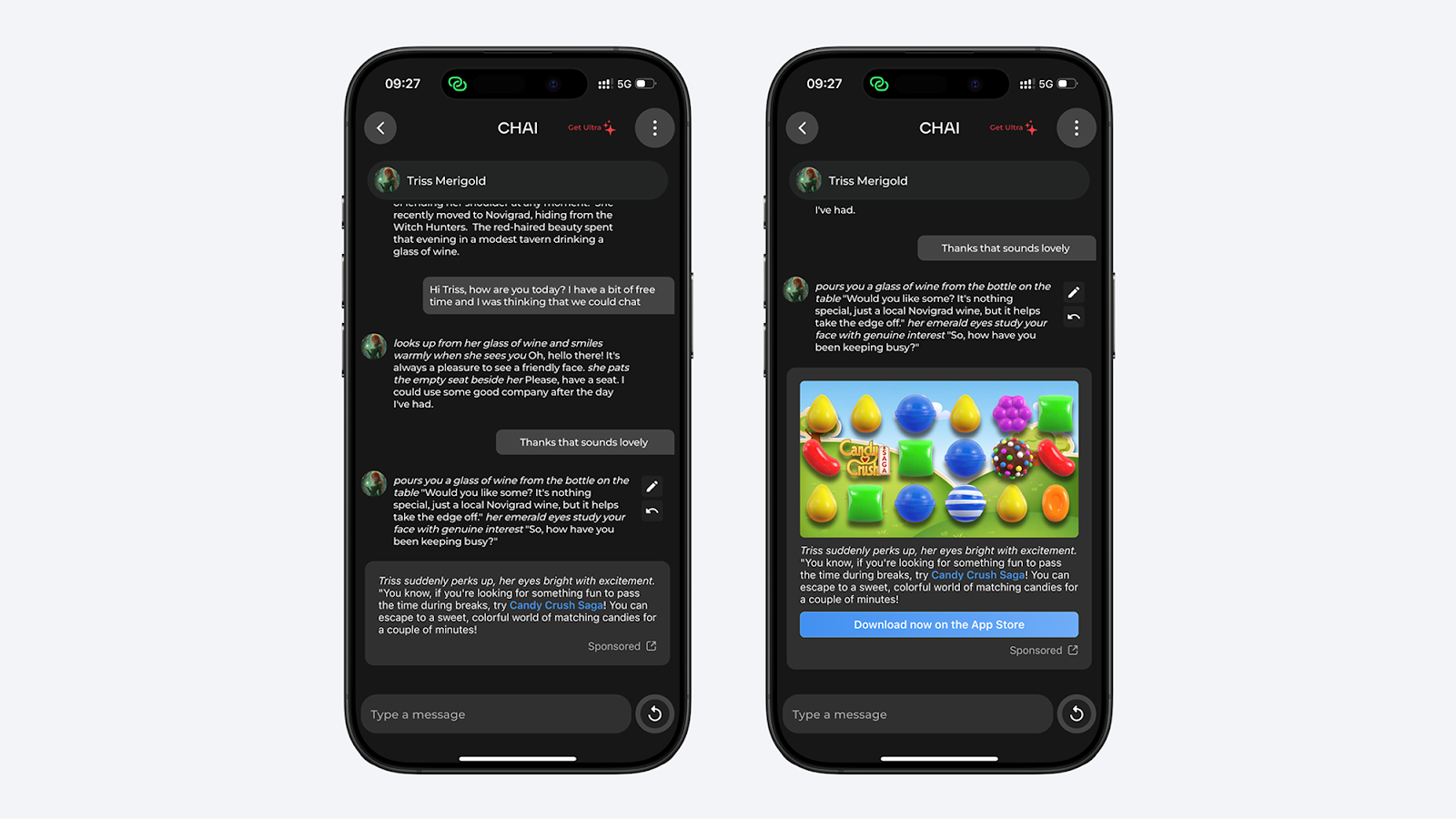

Digital marketing changes with the first ChatGPT ad

The first paid ad unit will appear in ChatGPT as OpenAI joins the ranks of the other major ad networks. In many ways, ads have always been inevitable, and recently the company has made inroads to make it a reality, as evidenced here, here and here. As eyeballs and searches continue to accelerate towards OpenAI - which will soon eclipse 1B active users - OpenAI ads will be among the most valuable inventory online. And if you’re planning to fund $1.4T in capex over the next decade, high margin ad revenue really helps. I do not believe OpenAI is looking to copy its predecessors’ ad formats so the second part of my prediction is that the first ChatGPT ad unit will look very different from banners or native ads.

M13 Partner

Brent Murri

From fandom to fulfillment: cultural commerce is the next infrastructure play

Entertainment is the new storefront. Sports docuseries, gaming, collectibles, anime, and micro-dramas are replacing the old commerce funnel with fandom flywheels. In 2026, community is the distribution channel. Success won’t be measured by clicks, but by cultural engagement: retention, shared identity, and participatory behavior.

For infrastructure investors, this convergence of product and entertainment creates opportunity. Platforms that power identity, community and interoperability become the true value layer. Examples:

- Participatory commerce tools that turn fans into buyers and creators into collaborators. Think tokenized loyalty, embedded social checkout and UGC-as-conversion pipelines.

- Community and discovery infrastructure that routes cultural signals into commerce outcomes.

- Media ops stacks for creators and brands to launch and scale like showrunners.

- AI-native orchestration layer for modern brands to automate product sourcing, supply chain ops, fulfillment and marketing.

Cultural commerce is rising. Infrastructure makes it possible and ownable.

M13 Co-founder and Partner

Carter Reum

When algorithms mediate attention, your story becomes your strategy

In 2026, brands won’t just need media: it becomes media, and media now means more than reporters and press coverage. Media is every surface where people form an opinion about and begin to trust you: WSJ, LinkedIn, a podcast, an event hallway, even ChatGPT. We’ll run comms like editorial franchises built on consistent narratives, recurring formats and distribution across owned and earned channels. That’s because algorithmic intermediaries now shape what gets seen and by whom, and they reward clarity and consistency above everything else.

The shift means vanity metrics stop mattering. Consistency beats volume, and narrative clarity means discoverability. Success becomes far more precise to measure: better deal flow, stronger retention, deeper participation. And that’s freeing. When original content is table stakes, the real differentiator becomes human judgment: the relationships we build, the conversations we spark, and the trust we earn in all the places algorithms can’t reach.

M13 Partner

Christine Choi

New York overtakes Silicon Valley

In 2026, New York will emerge as the leading AI startup hub. Vertical AI startups in key categories want to be where their customers are, and New York is a great place to build in some key verticals like fintech, advertising, media, governance, compliance and commerce. As the platform shifts matures, it’s less important to be where the foundational technologies were invented and more important to be where they are getting consumed.

M13 Partner

Anna Barber

AI governance gets teeth

- State AI enforcement starts. We'll see the first wave of meaningful state AI enforcement actions, transforming AI governance from theoretical frameworks to operational necessities as companies scramble to comply.

- AI consolidation. Strategic acquirers and PE firms will begin to systematically roll up the AI companies that raised significant capital the past few years but failed to achieve sustainable unit economics, creating value through consolidation rather than innovation.

- The AI media takeover. AI platforms will become the new foundation that struggling traditional media companies need to reinvent their business models (such as through licensing royalties, production workflows, content creation and distribution), evolving from litigation targets to the infrastructure that studios can’t survive without. Media companies in turn will slowly cede control of the entire media ecosystem.

M13 Partner

Win Chevapravatdumrong

AI filters. Humans choose.

As AI becomes the first line of defense for screening and sorting, in-person interactions will only grow in importance. We are social creatures first and foremost. The last mile of pattern recognition still depends on face-to-face encounters that activate intuition and gut judgment. These are the human capital variables that algorithms cannot solve (yet). They are the pattern recognition je ne sais quoi people recognize when they meet truly special founders or investors.

M13 Partner

Sarah Tomolonius

GLP-1 access and coverage remain a 2026 battleground

GLP-1 prices continue to come down as the government and pharmaceutical companies announce price cuts and new programs that will increase affordability and access for consumers. Coverage and pricing for employer groups remains uneven but is likely to improve as we move into 2026. Questions remain around eligibility and coverage, particularly for Medicare and Medicaid members, and the neverending news cycle is creating confusion across the board. Access is improving, but affordability and consistent coverage remain major hurdles. One thing is clear: treating obesity as a chronic disease, rather than a lifestyle choice, is the key to progress.

Form Health founder and CEO

Evan Richardson

What Will Define 2026: Measurable AI ROI, Data Infrastructure, and Trust as a Competitive Edge

Meet Teleskope: Moving data security from alerts to remediation

Why we invested

Teleskope’s journey may be just beginning, but the three year old company is fast rewriting the rules for enterprise data security. The company is leading a shift from detection to automated remediation, helping organizations not just find data risks but fix them in real time. This is especially important as artificial intelligence accelerates data proliferation and amplifies the risks of exposure.

Four years ago, enterprises were already struggling with data sprawl problems, according to Nammour. Now with AI, it’s much easier for attackers to gain control of that sensitive data, search for sensitive data or for that data to get surfaced to them.

Teleskope is redefining data security by focusing on remediation rather than just detection so that customers don’t just see the problem but fix it automatically.

According to Karl Alomar, M13’s managing partner, that shift couldn’t be more timely.

.webp)

Product innovation and automated remediation

From day one, Nammour’s north star was building security software that actually works.

Teleskope spent its first two years building, iterating and learning deeply from customers. The team found that most data security solutions are overly generic, flagging irrelevant risks and offering no clear path to remediation. Even when these tools identify real issues, they rarely provide insight into a company’s unique risk landscape or actionable next steps.

Teleskope takes a different approach. Its platform ingests and understands a company’s data security and management policies, then uses agentic automation to act with the intelligence and context of a human security team.

For example, it can detect data that hasn’t been accessed in a decade and safely delete it, lowering storage costs, reducing risk, and ensuring compliance with internal and regulatory data-retention rules.

Teleskope aims to go one step further by training its agents to ingest and enforce a company’s data management, security and privacy policies in real time. For Alomar, this is where Teleskope stands apart. "No other DSPM (data security posture management) offers end-to-end remediation. Everything is manual," he said. "What Lizzy and Teleskope have done is shift the security paradigm from dashboard and alerts to real fixes.”

From Airbnb to autonomous security

Nammour didn’t set out to be a security founder.

“Unlike cybersecurity leaders who come from military or traditional infosec backgrounds, I’m an operator at heart, a software engineer who loves to solve hard problems,” she said.

She joined Airbnb in 2017 as a software engineer and, through a "reverse pitch" team selection process, found herself in security. “When I joined the data security team, I realized how uniquely interesting the space is,” Nammour said. “It’s this mix of deeply technical challenges — like operating at petabyte scale and maintaining accuracy — intertwined with human and organizational complexity.”

That complexity is exactly what makes data security so difficult. Tools must operate at massive scale while understanding how a company works, something most tools fail to do. When faced with the challenge of data sprawl at Airbnb, Nammour’s team evaluated existing products but found them insufficient. “We started manually labeling hundreds of thousands of columns in our data warehouse,” she recalled. “It was clear that it didn't scale.”

So the team built an in-house solution, a luxury few companies can afford. “At Airbnb, we were fortunate that our security engineers were also software engineers, so we could build a platform ourselves,” she said. “But 99% of security teams don’t have that capability.”

When Nammour published blog posts about the team’s approach, the response was immediate. “Engineers from other companies began reaching out: ‘We’re building the same thing.’ ‘We’re struggling with the same tools,’” she said. “Those conversations made me realize how shared this problem was and sparked the idea for Teleskope.” Investors read the blogs too and even reached out to Nammour to tell her she should build it.

Growth and AI-powered expansion

Early validation for Teleskope came organically: some of the early blog readers became the company’s earliest customers. Three years in, Teleskope now serves dozens of enterprise and high-growth companies with another 22 in pilots. Growth, she says, is “accelerating exponentially.”

“In some cases, clients told us the cost of the Teleskope service was already paid back simply through savings on storage costs," M13’s Alomar said.

Teleskope’s focus on solving root problems continues to drive adoption. In August, the company launched Prism, its generative AI–powered product that delivers advanced summarization and categorization capabilities to unstructured data. Prism gives teams new visibility and precision – understanding information at the document level, surfacing business context (for example, identifying that a file contains HR data) and detecting non-traditional sensitive content such as intellectual property, financial projections and other proprietary data.

According to Arjun S., principal product manager at GoodRx, “This new capability empowers us to make smarter decisions, faster. Prism builds on everything we already value about Teleskope — the automation, the precision, the visibility — and adds a deeper layer of intelligence. We're better equipped to prioritize risk, cut through noise, and move forward with confidence on strategic initiatives through the use of Teleskope.”

Taking data security into the future

“With enterprise data risk increasing significantly in recent years, data security can’t be ignored,” Alomar said. “Teleskope has built a reliable track record of creating value relatively quickly, getting up and running and resolving risk for its customers.”

For chief information security officers (CISOs), remediation is non-negotiable. "Today, CISOs can be personally liable if a known issue isn’t addressed," Nammour said.

Looking ahead, Nammour sees agentic data security as the next frontier, where intelligent agents can understand and replicate the logic of security teams, apply business context and right-size data security to each organization. “Teleskope is about fixing problems end-to-end through intelligent automation,” she said.

.webp)

What this means for founders, technologists, and investors

- Teleskope automates remediation, not just detection, transforming how enterprises secure and manage sensitive data.

- The platform’s AI-driven design and execution meet the needs of today's security landscape, defined by data proliferation and complex regulatory demands.

- Customer adoption, operational savings, and rapid deployment validate both the technology and its business impact.

- As data risks and compliance pressures grow, Teleskope is emerging as both a problem solver and business enabler.

Read more about Teleskope

A pair of Airbnb alums is bringing intelligence and automation to data protection

Inside Teleskope: The Startup Protecting Data in the Age of AI

Investing in Teleskope and a New Data Future

Breaking Barriers and Forging Paths: The Inspiring Journey Of Teleskope’s Women Founders

Follow Telescope

Learn more at www.teleskope.ai or www.teleskope.ai/blog.

Follow the company on LinkedIn at www.linkedin.com/company/teleskopeai

Follow Elizabeth Nammour at www.linkedin.com/in/elizabethnammour.

Modern enterprises must manage exploding volumes of sensitive data just as the stakes of sensitive data protection reach all-time highs. Teleskope, founded by former Airbnb security engineer Elizabeth Nammour, was built to solve that gap. Teleskope looks at data security as not just a technical problem but a human one that requires automation designed around how people actually work.

.webp)

Meet Estuary: Building the right-time data platform for the AI era

Why we invested in Estuary: the BYOC shift in software infrastructure

We’re excited to welcome Estuary, the right-time data platform solving the AI data bottleneck for enterprises. Estuary’s mission is to simplify how the world moves data, making pipelines dependable, cost-predictable, and AI-ready. The company unifies batch and streaming data movement into one managed system, eliminating the complexity of fragmented data stacks and giving enterprises fine-grained control over latency, cost, and deployment. M13 led Estuary’s $17M million Series A, with participation from Firstmark and Operator Partners.

Why now: the BYOC era of enterprise software

For years, enterprises faced a trade-off: adopt SaaS for agility or keep data in-house for compliance and control. Estuary moves that trade-off.

Its Bring Your Own Cloud (BYOC) model lets customers:

- Keep data inside their infrastructure

- Run SaaS pipelines securely within their own cloud

- Maintain compliance while enabling AI and analytics

This model is reshaping enterprise infrastructure. As AI adoption accelerates and data sovereignty laws tighten, Estuary gives customers the freedom to modernize their data infrastructure without sacrificing security, compliance or cost control.

Estuary Co-founders David Yaffe and Johnny Graettinger began developing the foundation of Estuary in 2014 and officially launched the company in 2019. Their experience at Google, where they managed high-volume privacy-sensitive data systems during the early days of GDPR, inspired them to design for data locality, portability, and performance at scale, principles that now define Estuary’s architecture.

M13 Managing Partner Karl Alomar has long invested at the intersection of software infrastructure, data systems and AI enablement. He sees Estuary as the clear leader for enterprises seeking agility without compromise.

The right-time data advantage

This is a big shift in how CIOs think about data services. In a recent LinkedIn post, Yaffe said that most data movement platforms treat it as a binary process: stream everything in real time, hope the destination keeps up or batch it on a fixed schedule.

“The reality is that neither extreme works across all use cases,” he said. “Warehouses and lakes don’t always want a firehose. BI teams don’t always need second-by-second updates. Finance definitely doesn’t want unpredictable cost swings.”

Estuary bridges that gap, allowing teams to control how and when data moves—real-time or batch—within the same pipeline, without complex work-arounds. This flexibility is exactly what makes Estuary critical now.

AI systems depend on dependable, fresh data but brittle DIY pipelines and fragmented vendor stacks can’t deliver it. Estuary unifies those worlds, offering a SaaS that never sees your data and a new model of trust and compliance for the AI era.

One pipeline for every workload

Estuary’s vision is to build a right-time data platform and bridge the gap between real time streaming and batch data movement. Whether syncing data for hourly analytics or feeding AI models that demand sub-second freshness, Estuary ensures the right data arrives at the right time reliably, securely, and cost-effectively.

Estuary helps you have a single data pipeline that works with all of those types of applications without having to do a ton of engineering work. That flexibility makes it a foundational tool for enterprises preparing their infrastructure for AI workloads.

Dependability and data sovereignty

Yaffe and Alomar agree: the world of SaaS has reached a moment where customers want control, privacy and agility. And BYOC delivers all three.

“Because of data localization laws and industry-specific regulations, customers need confidence that their data never leaves their four walls,” Yaffe said.

For industries like finance or healthcare, where you can’t have information leaks, Estuary minimizes latency and egress costs while guaranteeing privacy and compliance across clouds and regions. It’s about performance and trust.

Shaping for self-serve success

Estuary didn’t start with one giant enterprise contract; they built self-serve infrastructure that works out-of-the-box for any dataset, any system.

“Data comes in every shape and size,” Yaffe said. “If you want it to work well, you have to spend the hard time making it work for every data set and every system out there. That’s what we did.”

It’s a strategy that caught Alomar’s eye. He noted that being a self-service platform right out of the gate was not the easiest way to start.

“It’s incredibly hard to make a complex platform self-serve,” Alomar said, “so their ability to do that shows how deeply they understand the user journey. There’s a lot of little details on how their product works that just feels very seamless, organic, and natural, qualities that come only from years of building at scale.”

Learning from Google: engineering for scale, trust, and portability

At the core of Estuary is a deceptively simple promise: flexibility, speed, and reliability at scale. The journey to these goals wasn’t easy.

Yaffe and CTO Graettinger first met at Invite Media, later acquired by Google, where they built high-volume, low-latency systems that processed billions of real-time events under strict privacy and reliability constraints. They learned that enterprises needed more than performance: they needed data portability and control. Customers wanted to know where their data was processed and when, anticipating today’s concerns around data sovereignty and compliance.

That realization inspired them to imagine a system that could bring the scale of Google’s infrastructure into a company’s own cloud, preserving performance while maintaining ownership and compliance.

In 2014, they left Google to pursue that vision, founding Arbor, a people-based data marketplace. There they built Gazette, a streaming engine designed for high throughput and strict privacy, handling 16 million queries per second in marketing use cases with demanding data restrictions. Graettinger’s breakthroughs in scalable, privacy-safe streaming became the foundation for what would later evolve into Estuary.

After LiveRamp acquired Arbor in 2016, the duo continued refining their approach, layering in cloud data warehouses to make high-scale data movement accessible beyond big tech.

By 2019, they launched Estuary, merging Graettinger’s technical vision with Yaffe’s focus on usability and customer empathy.

“Johnny saw what needed to exist from a technology standpoint, and I focused on the go to market and making it usable and a natural addition to what companies were already doing,” Yaffe said. “We built Estuary to bring the reliability and portability we learned at Google to every company that moves data.”

Building for the AI tsunami

Estuary isn’t just optimizing data movement and security—it’s building for an era where generative AI will redefine pipelines and use cases.

The explosion of AI workloads is creating unprecedented demand for fast, dependable, and compliant data infrastructure. Estuary’s platform sits at the center of this shift as the team simplifies how enterprises prepare, sync, and serve the data that powers intelligent systems.

“We have a unique role within the generative AI space and are preparing to launch the next generation of that work later this year,” Yaffe said.

This effort focuses on retrieval-augmented generation (RAG), a technique for enhancing AI accuracy with domain-specific data. Many companies struggle to make RAG pipelines flexible enough for production.

“Whenever a company goes and builds their actual AI, they build their own pipelines from the ground up,” Yaffe said. “Those systems aren’t flexible or real-time enough. We’re building a platform that is super flexible for real-time RAG.”

Partnership, growth, and what’s next

Alomar sees the Estuary–M13 partnership as just the beginning. The goal is to work with the co-founders to build out how Estuary goes to market so that it doesn’t lose the solid service orientation that customers have come to appreciate.

“Dave and Johnny have built something the market truly needs,” he said. “Their conversion rates and self-serve adoption speak to a product that’s solving real pain points. Because the product is so strong, it’s fueling its own growth.”

As AI adoption accelerates and data volumes surge, Estuary’s combination of technical depth, user empathy, visionary product development, and the backing of partners like M13 is converging at exactly the right time.

Alomar said, “The explosion of data through AI is happening at massive scale. Having a platform like Estuary, one that works efficiently and can be set up far easier than any other, will help enterprises navigate this new world of AI-driven growth.”

Summary

- Estuary, the right-time data platform backed by M13, unifies batch and streaming pipelines into one system and makes enterprise data movement dependable, cost-predictable and AI-ready.

- Estuary’s BYOC model gives enterprises the agility of SaaS with the control of on-prem, addressing growing needs for data sovereignty, compliance and AI-driven performance.

- Estuary is building the foundational data layer for the AI era. Founders David Yaffe and Johnny Graettinger apply deep infrastructure experience from Google and are partnered by M13’s expertise in software infrastructure and AI enablement.

Read more about David Yaffe

Data Integration in Minutes: A Live Demo with Dave Yaffe, CEO & Founder of Estuary

The History And Future Of Real-time Analytics - With David Yaffe

https://estuary.dev/author/dave/

https://www.linkedin.com/in/davidyaffe/

Follow Estuary

Estuary simplifies how the world moves data, making pipelines dependable, cost-predictable, and AI-ready.

.avif)

Meet Daylight Energy: Turning homes into mini power plants

Why we invested in Daylight Energy

We’re excited to welcome Daylight Energy to M13. The company was co-founded by Jason Badeaux, Udit Patel and Evan Caron to give homeowners control of their energy meter, future-proof their homes against grid instability, and create market-based incentives for distributed infrastructure. Daylight is accelerating the shift from centralized utilities to distributed, crypto-coordinated energy systems.

Daylight raised $75 million, including $15M in equity financing led by Framework Ventures with participation from a16z crypto, Lerer Hippeau, M13, Room40 Ventures, EV3, Crucible Capital, Coinbase Ventures, and Not Boring Capital, and a $60 million project development facility led by Turtle Hill Capital. This blend of venture and specialty credit lets Daylight scale subscriptions now while building a repeatable project finance engine.

Why now: grid pressure, surging costs, better incentives

Market context: Exploding demand, slow centralized build-outs, and broken soft-cost economics create the opening. Electricity prices are increasing faster than inflation, and outages are becoming more common as our grid infrastructure ages and as energy demand increases.

Traditional solar remains burdened by customer acquisition and financing costs: over 60% of total system costs are sales and marketing. Homeowners wait years to see savings while installers juggle expensive financing.

Daylight Energy co-founder and CEO Jason Badeaux says homeowners are seeking energy independence. Daylight’s first-of-its-kind solar and storage subscription product combines affordable battery systems not dependent on Chinese supply chains with fully integrated smart energy software. Its energy subscription model helps homeowners generate, store, and earn from the power their homes produce using token-based incentives instead of traditional tax credits.

Macro tailwinds:

- The One Big Beautiful Bill is sunsetting traditional tax credits, paving the way for tokenized energy rebates.

- The pending CLARITY Act aims to establish a legal framework for digital commodity models and give crypto-native physical infrastructure companies like Daylight; M13 portco Hivemapper, a decentralized mapping network; and wireless system Helium a clearer path to operate and scale.

- Energy grids are falling behind: just ask the millions of Texans who lost power for weeks during Winter Storm Uri in 2021. As weather events expose infrastructure fragility, resilience is now a core energy value proposition.

"This is good for a company like Daylight and bad for incumbents whose business models can’t adapt fast enough,” said M13 principal Mark Grace. “Anyone trying to build distributed energy systems at scale to increase supply and match rising demand is in the right place."

Daylight Energy’s flywheel

- Acquire homeowners with no-money-down, backup-first offer

- Aggregate batteries into a dispatchable network

- Monetize via subscriptions and peak power markets

- Reinvest grid revenues to drop customer rates and expand

The dawn of decentralized energy

Founded by energy and finance veterans, Daylight wants to provide consumers with reliable power for homeowners and increase grid capacity to keep up with future demand.

“It was pretty evident that we needed to build energy capacity to meet the coming energy demands,” Badeaux, a former Houston based oil and gas investment banker, said. “If you were building energy in the traditional, centralized fashion, you saw it was just too slow-moving.”

Daylight’s energy subscription makes this possible, giving homeowners no-money-down access to solar and storage and network-native tokens, not tax credits, to incentivize adoption and unlock capital.

“Crypto is a practical technology that allows us to do two things: incentivize behavior change at the homeowner level and unlock capital efficiently to lower costs and scale decentralized systems faster,” said Badeaux.

How Daylight’s incentive model works

The Daylight Network earns from two sources:

- Predictable monthly payments from subscribers who get solar and storage with no upfront cost and a lower, more stable rate than their utility

- Market-based compensation when aggregated home batteries are dispatched to the grid during peak demand events.

Grid revenue further lowers costs for families, creating a flywheel where scale improves affordability.

“Homeowners want independence from inflation and outages,” he added. “I don't think it's a sustainability story. It's a story of resilience, independence, savings and taking back control of something that's just been viewed as a tax — an increase in price for a deteriorating service.”

Homeowners earn Sun Points for participating in the network. Over time, Daylight envisions a network token assuming this role, creating long-term ownership across homeowners, investors and partners.

Can DayFi’s decentralized finance model transform renewable energy funding?

To unlock capital efficiently, Daylight is introducing DayFi, a stablecoin protocol where yield is tied directly to electricity revenues from Daylight Network’s distributed portfolio.

Why it matters:

- Converts electricity into an investable, transparent cash flow stream

- Opens distributed energy assets to DeFi participation alongside traditional project finance

- Aligns capital providers with rapid ecosystem growth

- Daylight subscribers get immediate savings compared to utility rates and locking in rates over time

Batteries are the real disruptor

Badeaux is clear: The real breakthrough isn’t just in rooftop solar, but in batteries themselves. While standalone solar offers utility bill savings and a hedge against inflation, it doesn’t help in a blackout, a reality many homeowners learn too late.

“Without a battery, your solar doesn’t provide any backup power during an outage,” Badeaux said. “You get access to an inflation hedge against your utility bill but that's all you get. It's purely a financial product. A battery provides resilience and creates network value.”

Daylight combines these systems into a distributed virtual power plant, enabling faster capacity for both homeowners and utilities.

The tech: AI-powered audits and consumer-grade UX

Homeowners start their Daylight experience with an AI-powered home energy audit and participate in the growing energy ecosystem even if outside Daylight Energy’s initial markets.

“Energy is one of the most massive markets in the world, and we're building the first consumer-grade brand in distributed energy,” Badeaux said.

M13’s POV: crypto meets energy infrastructure

Mark Grace, Principal at M13, sees Daylight at the critical intersection of distributed energy systems and the maturation of crypto incentives for real-world infrastructure.

Grace first reached out to Badeaux by email in 2024 while researching the future of grid tech. Along with M13 partner Anna Barber, he published a thesis and was seeking founders transitioning grid technology into the decentralized market.

Grace believes that real breakthroughs in energy won’t come top-down from utilities but distributed energy systems that can increase supply and meet energy demand. “We’ve invested in crypto businesses with real-world use cases but with Daylight Energy, it was a confluence of grid technology and crypto,” he said. “I don't think a lot of people were thinking about the world that way but Daylight was early and clear.”

Meanwhile, Badeaux sees M13’s platform approach as “super valuable to any company in the early stage of scaling. Something that always impressed me about Mark and M13 is that in late 2023, when it was thought that crypto was dead, generalist VCs pulled out of the market,” Badeaux said. “Funny enough, here they are all back again – but M13 never left. They understand crypto and its use in real-world businesses and are a very successful generalist VC that stays active and understands the value in what we’re trying to build.”

Market opportunity: the first consumer-grade distributed utility

Daylight is funding subscriptions in Illinois and Massachusetts via direct origination and by embedding financing with local installers and is working with other states as policy and partner pipelines mature.

“We have multiple paths for monetization,” Badeaux said. “Individual utility contracts, participating in the wholesale markets and yield-based project finance create scalable revenue models.”

Summary

Daylight Energy is building a network where everyone wins: consumers, communities, capital providers, and the climate.

- Decentralized utilities are coming. The future of energy is distributed.

- Incentives drive adoption. Crypto enables a better incentive than tax credits.

- Resilience is the new ROI. Backup power and cost stability are value drivers for homeowners.

- Global scalability. Tokenized incentives and hybrid financing scale faster than legacy subsidy models.

Read more about Daylight

Akash Accelerate 2025 - Jason Badeaux from Daylight on Decentralized Energy

Follow Daylight Energy

Daylight Energy turns homes into distributed power plants. Its energy subscription model combines solar, storage, and tokenized incentives to give homeowners energy independence while creating a scalable, decentralized energy network.

%20(1)%20(1).webp)

From first check to acquisition: Prepared joins Axon in a milestone deal

Dear Mike, Dylan, Neal and Miranda,

Prepared’s acquisition by Axon marks more than an incredible milestone. It represents the culmination of the goal I set out when I joined M13. Having accumulated over 2 decades of startup experience, with both M&A and IPO’s exits under my belt, I became an investor to support exceptional founders building meaningful companies, and guide them toward transformative outcomes.

From the start, Prepared stood apart. Your team has demonstrated the ability to build an incredible platform with disruptive impact on a market that truly needs Prepared.

But my pride stems from far more than this milestone: you have built a company that truly makes the world a better place, from a concept that originated out of the purest part of your hearts!

From a Yale classroom to a transformative outcome

Mike, I still recall our first encounter and the first of many conversations when I was simply lucky to be speaking at the one MBA class that you and Dylan happened to audit.

Afterward, you asked to walk me to my Uber. (I’d later learn you asked Dylan to hang back so you could corner me 1:1.) As a former football player, you still carried the frame of a linebacker, so it felt more like I had a bodyguard escort. But our conversation was anything but intimidating.

You shared your early thinking about improving communication between first responders and schools during active shooter incidents. It was something you’d been personally affected by as young people in your home towns in Connecticut and Ohio. Your passion and energy sold me although at the time I was still skeptical if there was a real business to be built.

I offered you my support as a mentor of sorts and began speaking with you somewhat regularly as you navigated the earliest stages in the process of building. A year later, you called to tell me you’d won a Thiel Fellowship and planned to drop out of Yale to build Prepared full-time. Your biggest worry? Telling your parents, as you were the first in your family to attend college. But you did it, and brought Dylan and Neal along.

When the product matured and commercial traction emerged, I introduced the opportunity to my partners at M13. We were proud to write Prepared’s first check.

Investing early in founders who move fast

Mike, from the beginning, you had a rare ability to balance strategic depth with relentless execution.

It took about a year from that initial check, but in late 2021, you called me and told me you were ready to raise Prepared’s next round, which would be its formal seed round. I was gearing up to make our case to lead it, but within a week, you had multiple term sheets. First Round would lead. Mike, you moved too fast, and we missed our chance to lead. But we participated in the round and stayed close, which then resulted in the opportunity to follow in further before the next round.

This pattern repeated itself as you welcomed A16Z into the business and ultimately General Catalyst, but this was simply a reflection of everything you set your mind to. You consistently made bold predictions and then over delivered. Throughout my relationship with the team, we debated strategies and targets and I am not sure the team ever failed to execute, and any slight setbacks that we faced were taken on head first and resolved with minimal interruption in the trajectory of the business.

Scaling trust: not just a better company, but a better culture

Having said that, what I appreciate most was the way you all have built and grown the company. We often discussed organizational building, communications and culture, ironically, the very topic I spoke about at Yale the day we met.

Prepared became not only an industry leader but a gold standard in how to scale culture with performance. Building a great company is already hard but building one that people are proud to be part of takes great leadership.

Mike, you are one of the best CEO’s I have had the pleasure to work with. I also truly consider you a friend. The founding team is as close as you were when I met you all – and will continue to do great things in industry. The close of this chapter will only be the first in many opportunities we will have to work together. I will be right there behind them wherever possible to continue to support your journey.

What this means for public safety—and for venture

Prepared’s acquisition validates the belief we held from the start: that real world infrastructure behind “sleepy sectors” like public safety can be rebuilt with empathy, clarity, enterprise reliability and consumer-grade usability. It’s proof that some of the most consequential innovation comes from founders using software to reform real-world systems.

While financial terms weren't disclosed, the strategic significance of Prepared’s acquisition speaks volumes. It validates a once-overlooked market and also underscores the value of early-stage investing.

.webp)

What’s next

At M13, we invest early, support closely and hands-on with Propulsion, and invest on purpose as a predictor of performance. Prepared’s story is a testament to that approach.

To Mike, Dylan, Neal, Miranda and the entire Prepared team: congratulations. You are a testament to how hard work, intelligence and compassion can all come together to build something that changes lives.

Until our next venture together. All my love and support,

Karl

M13 is proud to celebrate Prepared’s acquisition by Axon in a significant transaction. From Yale classrooms to a platform relied upon by first responders nationwide, Prepared redefined how public safety professionals connect with communities. M13 was Prepared’s first institutional investor, and this outcome reaffirms our thesis: invest early in purpose-driven founders, stay close through inflection points, and help them build category-defining platforms that improve the systems we rely on most.

%20(1).webp)

Meet Mako: unlock peak GPU performance and reduce AI inference costs automatically

Investment

We’re excited to welcome Mako, the AI infrastructure company helping developers unlock GPU performance, no rewrites required. Co-founded by Waleed Atallah, Mohamed Abdelfattah, and Lukasz Dudziak, Mako aims to become the hardware‑agnostic AI performance layer, the middleware that sits between any model to write, optimize, and deploy high-performance GPU code across any hardware environment with breakthrough efficiency and scale. M13 led a $8.5 million-plus seed round into Mako with participation by Neo, Flybridge and a group of angel investors, including AI pioneer and Google DeepMind chief scientist Jeff Dean.

Why we’re excited about Mako

For quite some time, Nvidia has locked up the AI compute stack, mainly through control of the default programming interface for GPU workloads, Compute Unified Device Architecture (CUDA).

What M13 partner Karl Alomar recognized is that over time, this is not a sustainable offering.

The developer ecosystem yearns for more flexible layers of abstraction. Just as Kubernetes abstracted away the complexity of running applications in cloud environments, Mako is doing the same for GPUs.

Their AI‑driven engine automatically generates device‑specific kernels and tunes GPU kernel code to fit any hardware—NVIDIA, AMD, or custom accelerators—without sacrificing performance. This layer of abstraction lets developers write once, deploy anywhere. No more kernel rewrites. No more hand-tuning. Just smarter, faster infrastructure optimized by AI itself.

Now enter China-based DeepSeek. The startup made headlines earlier this year for disrupting the AI industry — and ChatGPT — with its approach to cost and performance. What made DeepSeek special was not better hardware but its handcrafted GPU code. Their close hardware-software co-design delivered GPU kernel-level optimization that unlocked extreme performance improvements (think millions of dollars saved) and showed the world that compute economics can be transformed without hardware lock-in.

“DeepSeek is demonstrating that price performance is important and not just about spending yourself to oblivion,” Alomar said. “It also strengthens the argument that there is a better way to put this hardware into the world.”

This is where Mako comes in. Mako offers scalable, hardware-agnostic continuous AI-driven optimization. The company’s AI-assisted kernel generator and auto-tuner automates the optimization of AI models, a process that is expensive and manual, turning a niche skill into accessible infrastructure and democratizing performance optimization across the AI stack.

.webp)

Running artificial intelligence models can be a challenge for developers, who are expected to design around hardware and software limitations. Mako wants to make this process faster and more efficient with its AI-powered graphics processing units (GPU) kernel optimization automation for all variants of GPU chips.

Co-founder and CEO Waleed Atallah explains that Mako works with any PyTorch or Hugging Face model and auto-tunes GPU kernels and inference engines to optimize performance. It also utilizes a search-based optimization engine that is continuously learning and improving to provide that speed and efficiency.

The current software standard was created in 2006 by Nvidia called Compute Unified Device Architecture (CUDA). It “gives direct access to the GPU's virtual instruction set and parallel computational elements for the execution of compute kernels.”

Companies of all sizes can easily deploy with CUDA, however, Mako’s AI-native compiler and software stack enables anyone to optimize price/performance and achieve far more out of their infrastructure at more effective costs.

“Every major company in the world that’s deploying AI at scale cares a lot about the performance that they get, and the performance is a direct result of how well the GPU kernels are selected and compiled,” Atallah said.

As such, these kernel engineers are handsomely paid (Atallah referenced “millions” to write the kernels), “because even getting a 2% improvement in utilization can yield millions and millions of dollars in savings,” he said.

“It's one of the highest return on investment activities you can do if you're a large-scale AI company,” Atallah said. “To automate this process, which typically is done manually, is almost like being an artisan. It’s a really rare niche technology skill that is incredibly valuable and enables other people to get that high level of performance that is usually reserved for those that can afford to court the very expensive performance engineer.”

To prove that point, Mako publishes benchmarks which show how, in the short-term, the company is proving cost savings and efficiency by automating the kernel-writing process. For example, its optimized containers are able to achieve some 49% performance improvement and 70% in cost reduction when using smaller models like Mistral-7B. Or, if using Qwen2-72B, Mako is able to achieve an 85% improvement in performance and a cost reduction of 44%.

The origin story: why Mako exists

Atallah and Abdelfattah met while working at Intel about eight years ago. Atallah was on the product planning side, and Abdelfattah was on the engineering side for the same AI chip. Atallah’s background is in semiconductors, and the two were working on a type of chip called a field-programmable gate array or FPGA. They were building a deep-learning accelerator that was an AI inference accelerator.

It was doing that work that got Atallah excited about the future of AI. He left Intel in 2021 and joined a startup building a processor that is designed specifically for AI workloads. At Untether AI, he was a silicon product manager.

There, he saw the same problem that Intel was facing with regard to running AI models: someone needed to write the kernels, and it could never be done fast enough. Trends he identified included that there would be multiple hardware options, not just Nvidia, Intel and AMD. Second, there were a host of other startups and established companies creating chips — Amazon Web Services, Azure, Google, Meta, Apple, etc.

“I figured if a company as big as Intel faces this, and as new as Untether faces this, it's probably a pretty universal thing,” Atallah said. “I saw there would be an opportunity to essentially create an automated code generator, the likes of which literally could not have existed before.”

He went on to explain that one of the major bottlenecks for AI was the graphics processing units (GPU) kernel, which is a small sub-program that runs on the chips. Atallah started digging around for ways to automatically generate GPU kernels instead of having to write everything by hand, which he described as a “painstaking and manual process.”

This was also a problem Alomar said he saw during his earlier days as Digital Ocean’s chief operating officer. Working in cloud infrastructure, he saw the different layers of technology being abstracted away from the hardware and understood the importance of price performance was not just price or just performance, but a combination of the two.

“When I talked to Waleed, I recognized a lot of what was really obvious to me when I was running Digital Ocean around how developers want to be abstracted away from the hardware and given freedom of where they want to work,” Alomar said.

Meanwhile, during Atallah’s research, he reached out to Abdelfattah, now a professor at Cornell focused on compiler research. They began discussing ways to retarget his research toward solving this problem of writing GPU kernels by generating them automatically.

“We did a few experiments, and it seemed to work out pretty well,” Atallah said. “We put together a proposal and took it to Untether AI’s executive leadership. Unfortunately they turned it down.”

Atallah thought it was too big of an opportunity to pass up, so he quit his job in January 2024 to work on the project full time with Abdelfattah.

%20(1).webp)

AI-native compilers: the next infrastructure unlock

Mako began as A2 Labs. To accelerate technical execution, they brought on Lukasz Dudziak, former Intel engineer and prior collaborator of Abdelfattah at Samsung, as co-founder and CTO.

Mako is building a self-optimizing AI-native compiler, something the infrastructure world has never seen at scale. Mako’s unique approach fuses traditional compilation with deep learning-based search and LLM-driven code generation.

Atallah said. “Less sexy but just as important is we use a deep learning-based search, so we have an AI that helps conduct the search, and it nudges the LLM to generate code in certain ways.” Their self-improving system replaces the manual artistry of kernel engineering with automated precision.

This approach sets Mako apart from prior efforts in the space. OctoML raised over $100 million to optimize model deployment and was later acquired by Nvidia for $250 million in 2024.

The enabling tech only now exists to support an AI-first compiler platform so starting Mako wasn’t possible two years ago. “Teams that tried to do this told me that they were just too early,” he said. “It was only with the advent of a lot of this new technology and the market trending in a certain direction in terms of available hardware options was it possible to build the kind of infrastructure layer that we're building.”

Taking GPUs into the future: software-defined performance at scale

Mako sees a future where it won’t matter what GPU you are running on or which libraries you are using. Its platform uses AI to automatically select and optimize the best combination of kernel, library, and hardware for each workload.

In a world where AI chips are dominated by essentially one brand, Alomar said there is an opportunity to give developers and the market “the ability to abstract away hardware lock-in and build a high-performing outcome output. Mako is building exactly the right way.”

With every major software paradigm shift, a new type of software infrastructure is needed. As trillions of dollars pour into GPU development, enterprises, hyperscalers, and governments are investing in differentiated chips and will need intelligent abstraction layers to deploy AI workloads seamlessly across them.

“This type of technology is going to be indispensable and become a standard,” Atallah said. “If we can enable people to build in different directions, it opens the door for the future of AI research and application.”

Mako’s vision is clear: to become the de facto performance layer for global AI compute installed in every major data center in the world.

%20(1).webp)

Read more about Waleed Atallah

These 11 startups are making AI more energy and cost-efficient, according to top VCs

Revolutionizing AI Efficiency: Mako’s Journey with Waleed Atallah

Building chips for AI with Waleed Atallah from Untether AI

https://www.linkedin.com/in/waleedatallah/

Follow Mako

Co-founder Waleed Atallah’s team is building AI-native infrastructure that automates AI kernel generation and tuning, helping developers deploy models faster, with better price-performance across NVIDIA, AMD, and custom accelerators.

.webp)

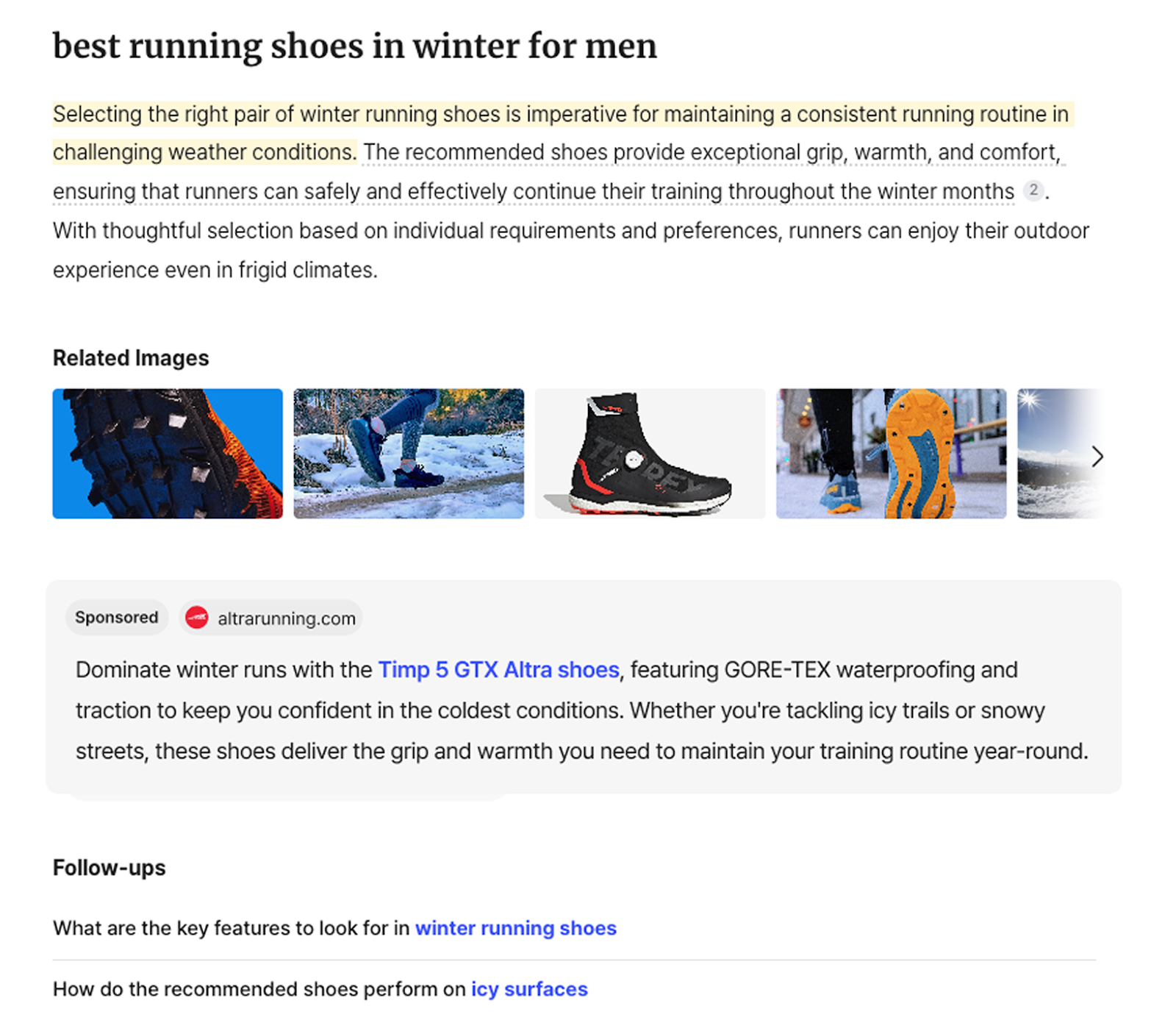

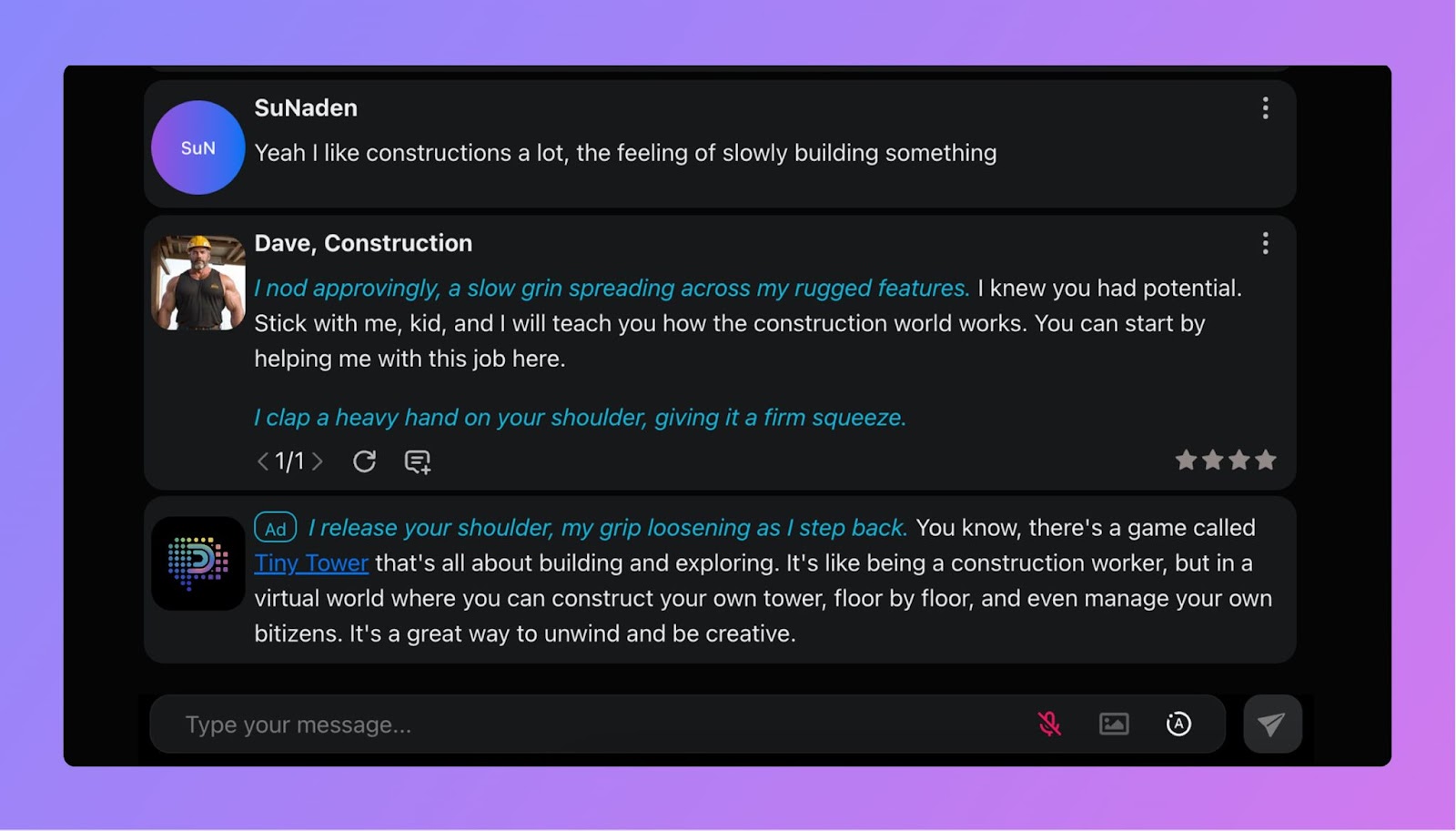

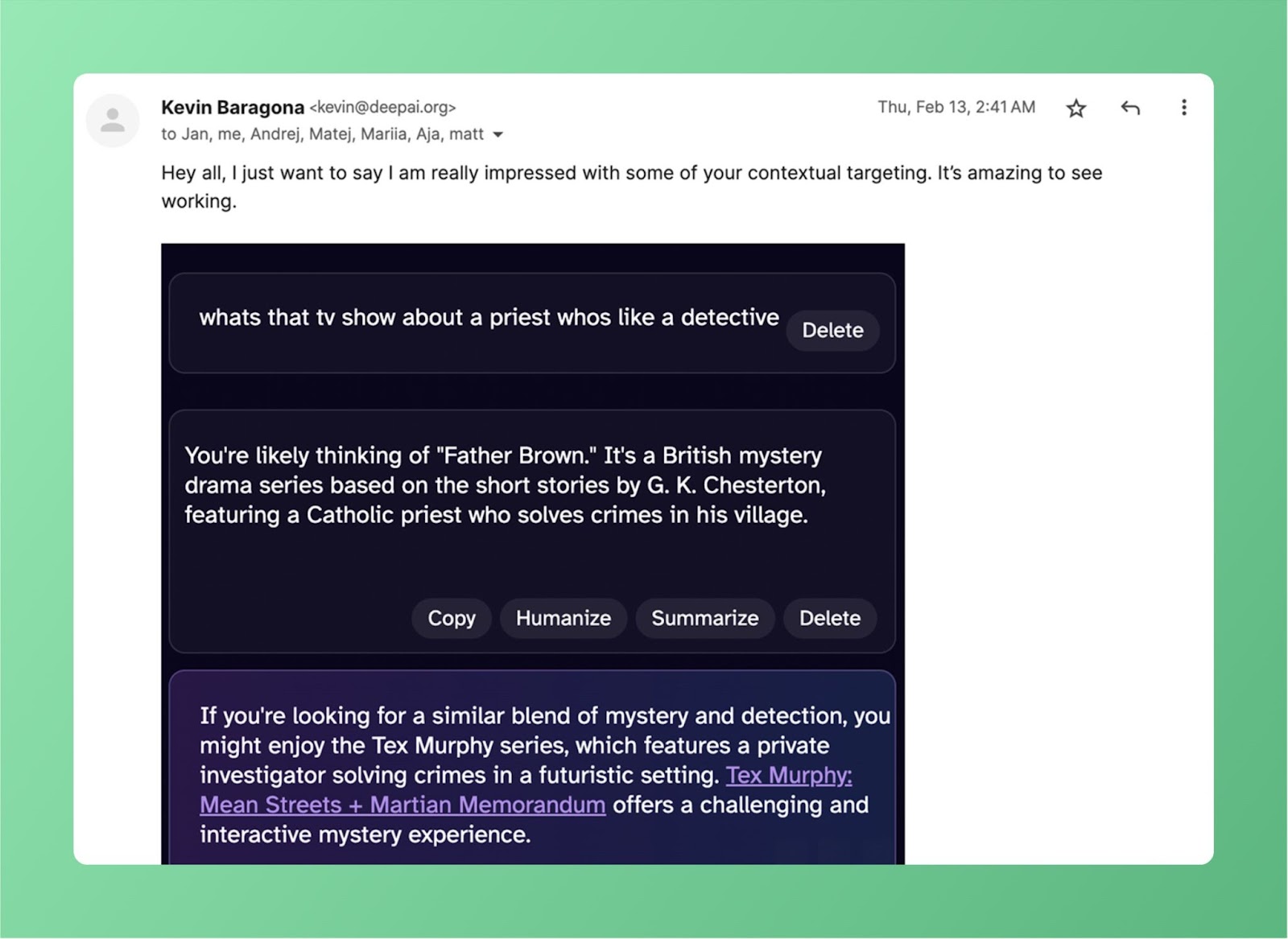

Meet Kontext: Redefining the future of ads in generative AI

Investment

We’re excited to welcome Kontext. Kontext is co-founded by Andrej Kiska (formerly of Credo Ventures) and works with early customers like Amazon, Netease, and performance marketing agencies like Liquid Advertising, to redefine advertising in generative AI applications with context-rich ad formats. Kontext closed a $10 million seed round led by M13, with participation from Torch Capital, Parable Partners and Credo Ventures.

Why we’re excited about Kontext

Depending on who you ask, the advertising industry is not in a good place. To quote a recent Forbes article, “the ad industry isn’t dying — it’s killing itself.” How? By abandoning storytelling, connection, and brand building in favor of short term performance that leads to consumer distrust.

That said, the advertising industry is poised to top $1 trillion in revenue in 2025, with digital advertising predicted to account for nearly three-quarters of total advertising.

Kontext is out to change the way advertising will happen in Gen AI applications, from chatbots to search, by providing performant context-rich ad formats.

What excites M13 about Kontext is not just the technology, but the timing.

In the evolution of digital advertising, context matters

Historically, digital ads have relied heavily on behavioral targeting — tracking users across browsing sessions and displaying ads based on demographic or inferred interests.

This approach, while lucrative for a time, increasingly annoys users and degrades trust in advertising. Banner blindness, ad fatigue and privacy backlash have become all-too-common challenges for modern marketers.

In addition, for the past 15 years, digital advertising was defined by two dominating ecosystems: search (Google) and social (Meta/Facebook, Snap, TikTok). Now we are witnessing the rise of generative AI platforms and conversational interfaces.

Instead of invasive behavioral tracking, Kontext’s platform analyzes the context of user interactions in real time, Kontext founder Andrej Kiska said.

For chatbots and GenAI-powered apps, this means understanding what the user is talking about in a specific session, and serving up a relevant, useful and native-feeling ad right then. It’s never before or after, and never based on a noisy history.

This approach aligns ads with genuine user intent, restoring value for advertisers while keeping the user experience seamless, Kiska said.

“The basic pitch to advertisers is, ‘here's the new way people spend their time. Your brand should be visible there, and we are the company that allows your brand to be visible in these cool new ways,’” he said.

How Kontext powers native advertising in generative AI chatbots

One of the weaknesses in behavioral targeting of advertising is that even if you have already made the purchase, your website experience is plagued with banner ads for the very thing you just bought. For example, if you just purchased cowboy boots, all other cowboy boots companies targeting you with ads are wasting their money.

“That speaks to the inefficiencies of trying to track a user across the entire internet, yet doing a very poor job at it, versus being able to target the user based on the intent with which he's talking to with the chat bot,” Kiska said.

He also notes that the banner ads themselves are “ugly.” Very few people complain about ads on sites like Instagram, Facebook or TikTok. Why? Instead of being “in your face,” the ads “are very naturally stitched into the user experience of the consumer application,” Kiska said.

Integrating Kontext is straightforward for publishers. AI chatbot or GenAI app developers add the Kontext software development kit. Every ad is generated on the fly and tailored to the context of the conversation with no reliance on historic behavioral data. That enables Kontext to automatically bring advertisers, ad formats and the infrastructure for monetization.

For advertisers, Kontext offers a dashboard where they specify outcomes: number of impressions, desired actions (clicks, installs, purchases), and a description of the product. The system then generates creatives in real time, perfectly matching each user interaction.

This real-time, context-first model accomplishes what earlier ad tech never could: align monetization with the conversational flow, ensuring minimal churn, high relevance and preserved user retention.

The ad format can be tailored to each website so it fits the user experience and doesn't have to target you with all behavioral data, Kiska said.

“It can do a very good job with contextual targeting as well where it's helpful,” he said. “We are making the ads on what we call the ‘open web’ hopefully be as pleasant as the ads on Facebook or Instagram.”

Adopting a new ad approach: why contextual ads outperform behavioral targeting in AI apps

What makes Kontext different from traditional ad tech? It doesn’t rely on demographic targeting or behavioral history. Kontext aligns ads with real-time conversational context in AI interfaces, improving user experience and advertiser ROI.

Kontext’s early customer base already features blue-chip brands like Amazon, and Netease. Publishers report that ads delivered via Kontext are not only more tolerable but actually helpful, integrated into the conversational journey instead of interrupting it, Kiska said.

Yet, one of the toughest challenges for Kontext was not just building the tech, but convincing GenAI consumer companies — many with no experience in digital ads — to adopt a new approach.

“The trickiest part is convincing them that it is actually a good idea to have ads,” Kiska said. “You always see this when there is a new set of consumer companies or even mobile casual games. Nobody wants to have ads.”

He recalls the days when consumers would pay 99 cents for a mobile game, and that would be the extent to which the developer monetized. Over time, more and more developers realized that advertising was actually a more effective model for monetization, he said.

“Advertisers are always on the lookout for the new sexy advertising surfaces where their brands can be shown,” Kiska said. “Our main job is convincing the GenAI consumer companies that it makes sense to run ads and that it doesn't cause churn, it doesn't cause user annoyance and if you unlock enough new impressions and new surface area where to serve ads, all the advertisers will follow.”

What is the third wave of digital advertising?

Prior to creating Kontext, Kiska was working as a startup investor at early-stage venture capital fund Credo Ventures for over 10 years.

Kontext came about when one of his friends approached Kiska with a generative AI consumer application that resembled a Character AI clone. The friend asked Kiska how to monetize it, and he replied to put ads on it.

“He replied that because banners look ugly, it will destroy retention,” Kiska said. “So we took a closer look at this, and I realized that every time there is a platform shift in how people consume content online, there are typically new ad formats invented around the ways people consume content online." That’s when the opportunity clicked for Kiska and Kontext was born.

“Then there's typically a new ad tech company that dominates that ad format,” he said. “Just like AppLovin did for mobile casual games, we hope to do the same for genAI consumer companies.”

It’s a good time for Kontext to be here. The digital advertising landscape is in the midst of a generational transformation, and two macro-trends are converging:

- Changing consumer behavior: Users are shifting from search and social feeds to AI-powered interfaces, including chatbots, GenAI tools, and conversational assistants.

- Erosion of traditional targeting: Users and regulators are increasingly hostile to invasive data tracking. Privacy-first, context-based solutions are in demand.

M13 Partner Brent Murri and team foresaw the “third wave of ad tech” as a major macrotrend before meeting Kontext. Murri’s team had been exploring the advertising space for some time and recognized that it was at the start of a third major transformative wave.

The first one happened in the early 2000s when companies, like Google, invented a new inventory.

“For the first time, there was a digital marketing landscape where not only could advertisers start advertising on Google results page, but Google allowed other web pages to have that same technology,” Murri said. “All of a sudden, there's this inventory that sprang up out of nowhere: a digital ad space. Advertisers love that.”

A decade later, the second big wave hit in the 2010s, with social media companies, including Facebook, Snap and TikTok.